WASHINGTON – House Democrats on Monday unveiled a plan to raise more than 2 2 trillion in taxes for their expanded social policy and climate change package, primarily on wealthy individuals and for-profit companies.

But while the proposal was large-scale, it reduced the necessary changes to reduce the vast fortunes of tycoons like Jeff Bezos and Elon Musk, or to completely close the extremely dangerous loopholes used by high-flying captains of finance. His aim was to go after the rich more than just the rich.

Faced with the fragile politics of a narrowly divided Congress, the senior House Democrats preferred to focus more on moderate concerns than on their party’s progressive ambitions. He focused on traditional ways of raising revenue: rather than targeting wealth itself by raising income tax rates.

“To be for something is not to become a law; With 218 votes in the House, 50 votes in the Senate, and the President’s signature, it becomes law, “he added.” What I don’t want is another noble defeat. “

The proposal includes an increase in tax revenue of about 1 2.1 trillion. Democrats say the increase will go a long way in funding President Biden’s ambitions to increase the federal government’s role in education, health care, climate change, paid leave and more.

But the bill comes with measures taken by the White House and Senate Democrats to tax property or close the avenues used by the superchargers to make a tax-free lifetime profit for their heirs.

Oregon Senator Ron Wyden, the Democratic chairman of the Economic Committee, said, “It would be a big mistake for Congress to pass a bill that really exempts billionaires.

Leading Democrats warned Monday that the House proposal is likely to change – perhaps significantly – because Mr. Biden’s economic agenda is rolling through the House and Senate, where Democrats have a small majority and need to put together almost every member of their ideologically diverse caucus. But White House officials welcomed the Wage and Means plan, saying that important steps have been taken in terms of the President’s tax code that rewards ordinary workers at the expense of the very rich.

The proposal includes substantial measures to increase taxes on the rich. Taxable income over $ 450,000 – or $ 400,000 for unmarried individuals – will be taxed at 39.6 percent, the highest rate before President Donald J. Trump’s 2017 tax cut to 37 percent. The rate of top capital gains will rise from 20 percent to 25 percent, much lower than the White House proposal that would have levied a 39.6 percent tax on investment profits.

According to the committee’s plan, an additional 3 percent tax will be levied on income over 5 5 million. The value of the estate protected from estate taxation, which doubled to जोड 24 million for married couples under the 2017 Republican tax cut, will reach 12 million by the end of this year, four years ahead of schedule.

The proposal would raise taxes on businesses called pass-through entities in a variety of ways ज such as many legal entities and financial companies जे that distribute profits to their owners, who then pay personal income taxes on them. Those changes, including an increase in the existing 3.8 percent additional tax to include pass-through income, would raise taxes primarily on higher earners, earning billions of dollars, according to democratic estimates.

The joint committee on Monday estimated that the changes would raise about 1 1 trillion from high-income individuals.

The proposal was rejected by the Republican Party. Business lobbying groups rejected the package, citing the U.S. Chamber of Commerce as “an existential threat to America’s fragile economic recovery and future prosperity.”

“President Biden, Speaker Nancy Pelosi and House Democrats are pushing for billions in wasteful spending and disability tax increases that will push up prices, kill millions of American jobs and take them abroad, and usher in a new era of government dependence. Expansion, ”said Kevin Brady, a representative of the committee’s ranking Republican from Texas.

But what is not included is remarkable. The richest of the rich earn less than their actual wages (Mr. Bezos’ salary as the founder of Amazon Mazon was 81 81,840 in 2020), so growth on income will not be much affected. Their vast fortunes in stocks, bonds, real estate and other assets grow largely tax-free every year.

“This proposal is very modest in the area of structural change,” said Eric Toder, co-director of the Center for Non-Aligned Tax Policy in Washington. “Mostly, it’s about raising rates on existing tax bases.”

In the Senate, Democrats are directly targeting accumulated wealth. The Finance Committee has proposed a one-time additional tax on billionaire assets, followed by an annual tax on profits from billionaires’ assets, as the property tax is adjusted each year to reflect profits from home values.

Mr Biden’s expanded tax proposals did not include property taxes during his campaign and as chairman. But he and the top senators had demanded various measures to impose higher taxes on inherited wealth and investments of high-earning people.

Bill Pascrel Jr., a representative of the Democrats on the Wages and Means Committee, New Jersey, acknowledged Monday that much of the country’s wealth is built on wealth, not big salaries. But he said many Democrats are afraid to go too far.

He said, “I am very skeptical of property tax. “I think it’s perceived as ‘soaking the rich.’

The committee found a loophole in the retirement savings used by billionaire Peter Thiel, who was able to take Roth’s personal retirement account into less than $ 2,000 in 1999 and raise it to $ 5 billion, according to a pro-public investigation. Be completely protected from taxes.

To prevent such exploitation, the Routes and Resources Committee will stop after contributions to retirement accounts reach 10 million.

In other areas, the committee seems to be focusing solely on wealthy Americans. Former President Barack Obama, Mr. Trump and Mr. Biden has vowed to close the so-called carrier interest loophole, in which private equity managers pay lower capital gains tax on the fees they charge customers, asserting that the money is not earned because it is derived from their customers’ investment profits.

The Senate Democrats are proposing to close the loop completely, which would save the Treasury $ 63 billion in 10 years. The House’s proposal will only limit practice, claiming Wall Street financiers as capital gains and cashouts before forcing them to keep their clients’ investment profits for five years. It would save $ 14 billion, a fraction of the Senate’s proposal.

Mr Biden’s expanded tax proposals did not include property taxes during his campaign and as chairman. But he and the top senators had demanded various measures to impose higher taxes on inherited wealth and investments of high-earning people.

Bill Pascrel Jr., a representative of the Democrats on the Wages and Means Committee, New Jersey, acknowledged Monday that much of the country’s wealth is built on wealth, not big salaries. But he said many Democrats are afraid to go too far.

He said, “I am very skeptical of property tax. “I think it’s perceived as ‘soaking the rich.’

The committee found a loophole in the retirement savings used by billionaire Peter Thiel, who was able to take Roth’s personal retirement account into less than $ 2,000 in 1999 and raise it to $ 5 billion, according to a pro-public investigation. Be completely protected from taxes.

To prevent such exploitation, the Routes and Resources Committee will stop after contributions to retirement accounts reach 10 million.

In other areas, the committee seems to be focusing solely on wealthy Americans. Former President Barack Obama, Mr. Trump and Mr. Biden has vowed to close the so-called carrier interest loophole, in which private equity managers pay lower capital gains tax on the fees they charge customers, asserting that the money is not earned because it is derived from their customers’ investment profits.

The Senate Democrats are proposing to close the loop completely, which would save the Treasury $ 63 billion in 10 years. The House’s proposal will only limit practice, claiming Wall Street financiers as capital gains and cashouts before forcing them to keep their clients’ investment profits for five years. It would save $ 14 billion, a fraction of the Senate’s proposal.

Another item is missing from the House Plan: a solution to tax heirs more aggressively. Mr. Biden and many other Democrats want property, such as stock and property on real estate, when they are inherited by wealthy heirs, based on an increase in value from the time the original owner bought them. Under current law, such assets are taxed on capital gains when they are sold, and when they are inherited, according to their value, all profits in the lifetime value of the superwealth remain ineffective until they are transferred to the heirs.

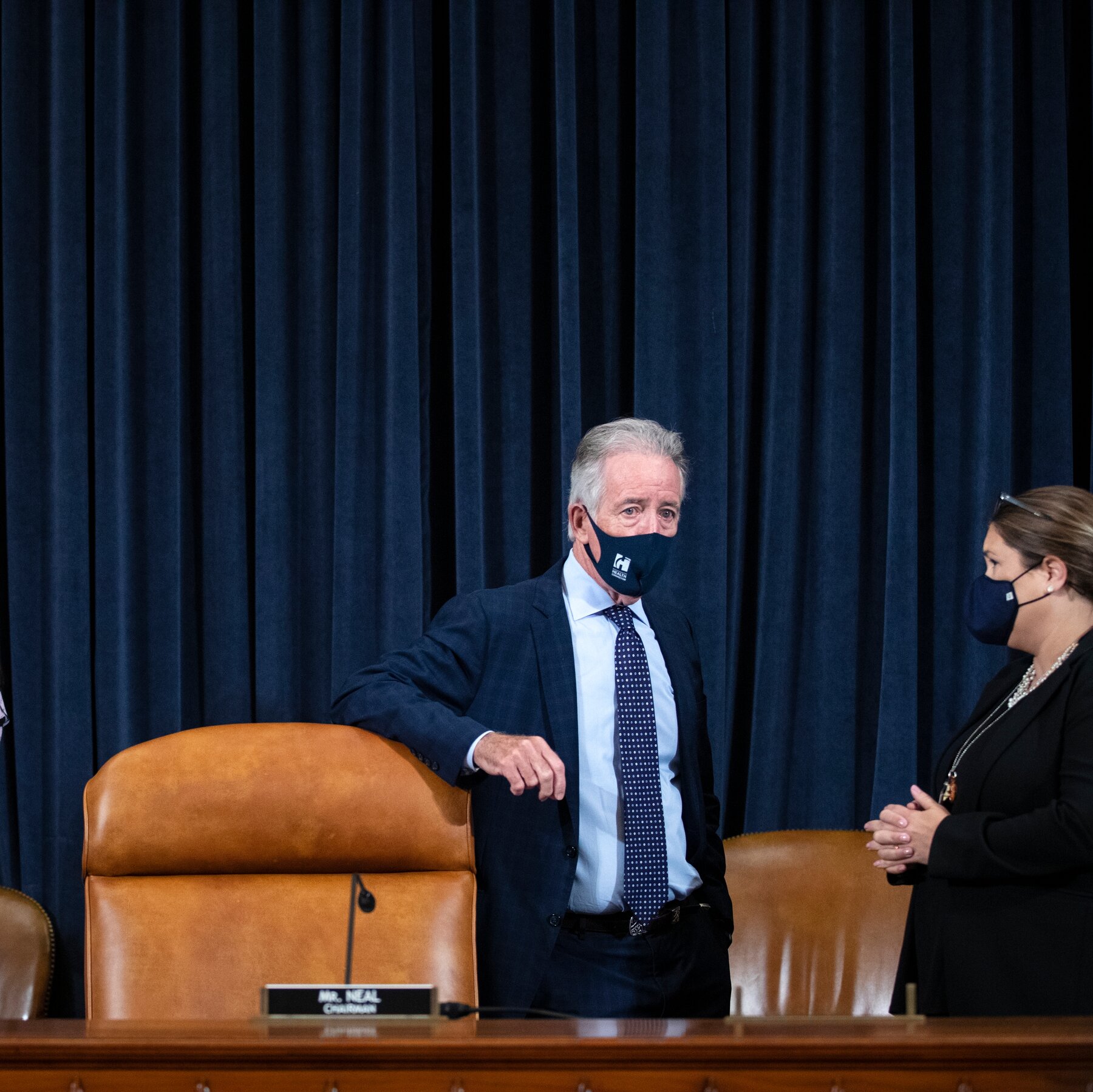

But the new proposal faced fierce lobbying campaigns, led by rural Democrats, such as former North Dakota Senator Heidi Hatcamp and Montana’s Max Box. Massachusetts representative Richard E. Neil, the Democratic chairman of the Roads and Resources Committee, left.

To some liberals, Mr. Neil’s pragmatism seemed more like a surrender.

“America’s billionaires are popping champagne tonight because the House Wages and Means Committee, chaired by Ritchie Neil, has failed, the country has failed, and history has failed,” said Erica Payne, president of the Patriot Millionaire. Tax more on the rich.

Some Democrats on Monday expressed surprise at Mr. Neil’s political calculations.

“Property tax? “I don’t know anyone who says this doesn’t work for them politically,” said Donald S. Bayer Jr., a Democrat from Virginia and a member of the committee.

But with West Virginia Democrat Senator Joe Manchin III suggesting that the final package should be half the size of the House plan, Mr. Bayer said he understands why Democratic leaders are reluctant to accept the most aggressive option of insecure lawmakers. .

“People will say, ‘You increased our taxes by 9 2.9 trillion,'” Mr. Bayer said. “Pelosi and the leadership don’t want to put too many threatened members in the Senate on anything that’s just going to die.”

White House officials welcomed the House plan Monday, acknowledging it is far from the final product.

“We see this as a first step,” said Karin Jean-Pierre, White House Deputy Press Secretary.

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Economymono journalist was involved in the writing and production of this article.